The mood at the S&P Global World Petrochemical Conference earlier this month was less optimistic than recent energy events as chemical producers struggle with over-supply in many end-use markets. High energy costs, inflation, and challenging supply chains combined to douse the early optimism of demand recovery, and most companies are bracing for a few difficult years.

Plastics Circularity was a recurring topic in many sessions, including a targeted pre-conference forum, and reflected a much more positive position than the overall chemicals market. Demand for recycled polymer is very strong, as confirmed by S&P Global price snapshot that recycled HDPE in Europe sells for nearly twice as much as virgin polymer.

Speakers in the Circularity forum shared an optimistic tone, and certainly high expectations. Attendees packed the room for the opening portion, eager to hear success stories from leading companies and collaborating parties toward achieving circular solutions for plastics applications. S&P moderator Mark Morgan quoted Charles Dickens ‘Great Expectations’ as he set up the discussion, acknowledging the perhaps too eager anticipation for the necessary technology breakthrough. “Technology will find a way, but maybe not on the timeline we expect,” Morgan offered.

Several large plastic producers have announced aggressive goals for recycling: Dow plans 3 million tons per year of circular and renewable solutions by 2030; Nova set a 2030 goal of achieving 30% of its polyethylene sales from recycled content; and Exxon expects to have 500kta of advanced recycling capacity by 2026. Exxon’s first advanced recycling unit in Baytown, Texas, began operation in recent months, and it plans additional units at its sites in the US, Europe and Singapore in the next few years.

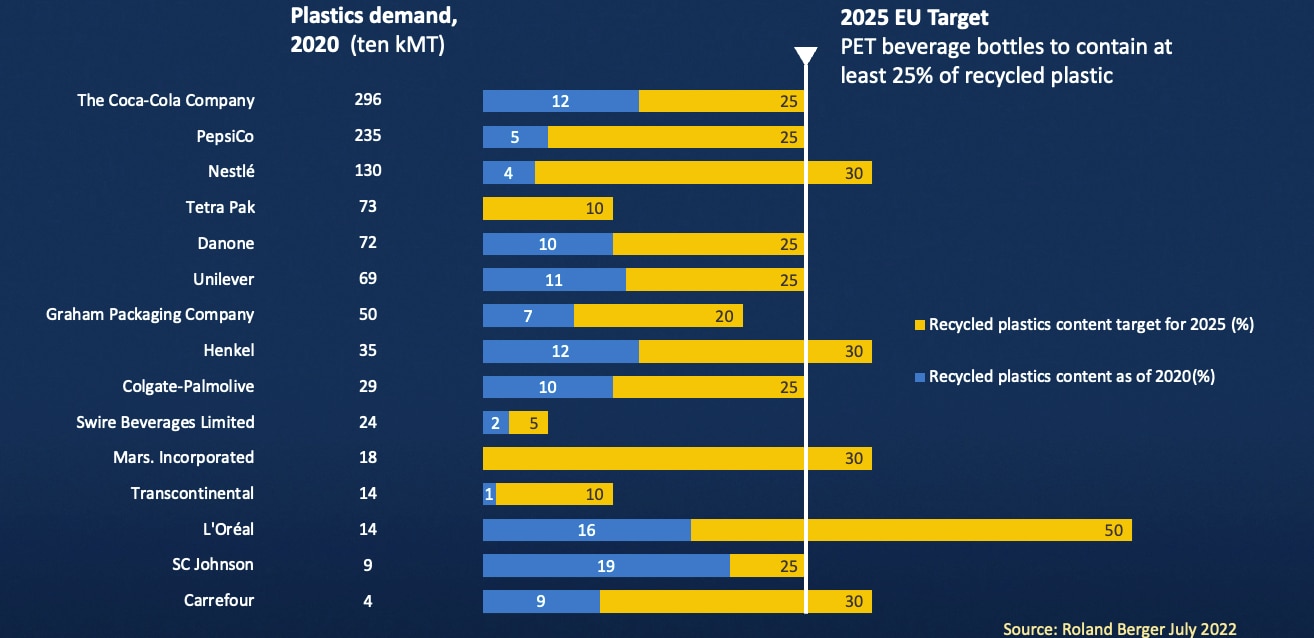

These activities represent early efforts to meet the more aggressive targets set by consumer product companies to integrate as much as 25% of recycled content in their products in the next few years. In contrast to the larger petrochemical industry, this is a case of demand greatly exceeding the supply of recycled polymers.

|

The range of technologies for plastic recycling is wide, covering both mechanical and chemical (sometimes called advanced recycling) processes. These processes differ in how they treat the base polymer: mechanical recycling does not alter the polymer structure when it is reprocessed; chemical processes break the polymer structure, reducing it to smaller molecules, from shorter hydrocarbon chains, starting monomers, or all the way to base synthesis gas (carbon monoxide and hydrogen). The preferred approach typically varies by the type of polymer and the existing infrastructure to support the operations.

Most companies agree that these are complementing technologies. Mechanical recycling works well for clean and clear PET and HPDE, plastics with #1 and #2 recycling symbols, that are well sorted. Mixed and dirty stream require chemical recycling to convert the range of materials to useable feedstock to make new plastics.

Mechanical recycling is well-established across the globe, particularly for PET. DK Agarwal of Thailand-based Indorama highlighted that it currently recycles 650kta of PET annually, using both mechanical and chemical recycling, and is targeting growth to 1.5b tons per year by 2030. The company is also active in community education programs to boost collection in regions where they operate.

For companies pursuing chemical recycling, technology efforts are earlier in the development cycle. Many of the production units are in pilot scale currently with more process optimization needed. These companies are working quickly and collaboratively to meet the high demand by consumer brand owners for recycled polymers, but much more effort is needed.

AspenTech is an active participant in this activity, working with companies to improve recycling processes using simulation. Customers can access starter models and AspenTech polymer expertise for several processes, including pyrolysis of polyolefins and glycolysis of PET. Additionally, we are helping to optimize supply chains to access post-consumer resin, including an award-winning solution used in Japan. Ongoing collaboration for plastic solutions continues to expand through our membership in the Alliance to End Plastic Waste, which provides funding for recycling projects in early stages and facilitates engagement across the plastic value chain to develop better solutions.

Bruce Chin, CEO at CPChem, reminded everyone in the executive discussion on circularity – “This is a marathon, not a short-term sprint.” And he noted that progress in the next few years will be critical to set the stage in capturing the value of plastic waste and stopping leakage to the environment.

Chin reiterated the company’s commitment to recycling even with the recent groundbreaking at the Golden Triangle Polymers project, a joint venture with Qatar Energy in Orange, Texas. “We need to encourage innovation and investment in the industry, not stifle it.”

Circularity for plastics can also be achieved using bio-based feedstock, as Braskem-IDESA CEO Stephan Lepecki reminded Latin America Petrochemical Summit attendees at the end of the week. In addition to its mechanical recycling efforts in Mexico, which includes 16 recycling centers and its first 30% recycled HDPE product, the company is also involved in biopolymers. Its parent company, Braskem, produces polyethylene from sugar cane—a product that has been waiting for this market. “When Green PE was launched 10 years ago, nobody wanted to buy it. Now demand is fantastic and we are expanding capacity.”

One of the most encouraging stories shared at the event was from an Alliance-sponsored project in Costa Rica. Donald Thomson from the Center for Regenerative Design and Collaboration (CRDC) shared their success in integrating mixed and dirty post-consumer resin into building materials. CRDC will soon add another production site in York, PA and has several other units in planning stages. “Thirty countries are waiting for product,” noted Thomson, as he explained the excitement and challenges with rapid growth.

These are exactly the type of success stories that need to be shared to reflect current investment and to encourage more activity.

.png?la=en&h=250&w=975&hash=901559A08FA0B38C4D6C97332902943A)

Leave A Comment