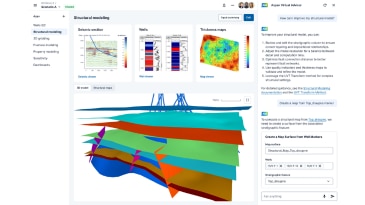

TotalEnergies to Roll Out AspenTech Inmation Across its Industrial Sites Worldwide

Aspen Technology is proud to share that TotalEnergies has selected AspenTech Inmation™ to continuously collect and centralize millions of real-time data points from the company’s industrial sites worldwide, ensuring secure and unified access to data.